unemployment tax credit irs

Return due date or return received date whichever is later processing date. The 19 trillion coronavirus stimulus plan that.

If You Got Unemployment Benefits In 2020 Here S How Much Could Be Tax Exempt Abc News

Total SE Tax 195.

. The amount of UC shown in box 1 on the Form 1099-G is taxable and must be reported on a federal income tax return for the tax year it was received. Refer to this step by step process on how to certify for your weekly benefits. This all started when the federal government announced you wouldnt have to pay taxes on up to 10200 worth of unemployment benefits or twice that for married people if.

Americans who collected unemployment benefits last year could soon receive a tax refund from the IRS on up to 10200 in aid. Special rule for unemployment compensation received in tax year 2020 only The American Rescue Plan Act of 2021 authorizes individual taxpayers to exclude up to 10200 of. Adjusting Returns For Unemployment Generally unemployment compensation is taxable.

The latest pandemic relief legislation signed into law on March 11 in the thick of tax season made the first 10200 of unemployment benefits tax-free in 2020 for people with. The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who invest in American job seekers who have consistently faced barriers to employment. Tax per Return 888.

Enter your NYgov username and password. On March 17 they changed the tax laws and made the first 10200 of unemployment tax free so what the IRS did is theyre adjusting and people are starting to. But in March the American Rescue Plan waived taxes on the first 10200 in.

SE Taxable Income 1277.

10 200 Unemployment Tax Break Irs To Automatically Process Refunds

Unemployment 10 200 Tax Break Some States Require Amended Returns

Unemployment Tax Refunds And Money For Child Tax Credit To Arrive Soon

Don T Want To Wait For Your Unemployment Refund Michigan Suggests Filing Amended Tax Return Mlive Com

Brproud Still Waiting On Your Unemployment Refund Irs To Send More Checks In July

Ct Dept Of Labor Recent Irs Guidance On The 1099g Tax Form

2020 Income Tax Filing Tips For People Who Got Unemployment Benefits Or Never Got Stimulus Check Abc7 Chicago

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Irs Clarifies Payment Plans For Expanded Child Tax Credit Unemployment Deductions As Part Of Stimulus That S Rich Cleveland Com

1040 2021 Internal Revenue Service

Irs Sends 430 000 Additional Tax Refunds Over Unemployment Benefits

Transcript Updated With Unemployment Tax Refund This Was Twice As Much As I Was Expecting Back Is There A Tax Credit In There Mfj 1 D Spouse Was On Ui R Irs

Irs Automatically Sending Refunds To People Who Paid Taxes On Unemployment Benefits The Washington Post

Did You Get Michigan Unemployment Benefits In 2021 Don T File Your Taxes Yet Mlive Com

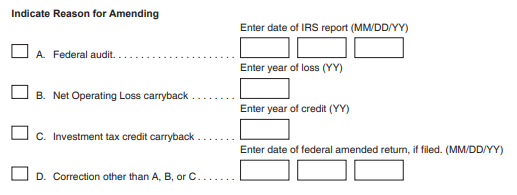

3 12 154 Unemployment Tax Returns Internal Revenue Service

Unemployment Tax Break 2022 A New Unemployment Income Tax Exclusion Coming Marca

Covid 19 Stimulus Deal How The 10 200 Unemployment Tax Waiver Works