franchise tax bd des

California law authorizes appellant to require any person in possession of credits or other personal property or other things of value belonging to a taxpayer. The tax rates for corporations are.

Pin On Kids Financial Education

Bakers and Clifford Chance act on Bangladeshs largest gas power project A syndicate of financial institutions and banks have been advised by Clifford Chance on the development and USD 642.

. Simply browse our directory to find your ideal franchise or business opportunity. This calculator can only be used to calculate stock that has par value. The tax is payable to the Office of Tax and Revenue OTR using Form D-30.

Bank Franchise Tax Every financial institution regularly engaged in business in South Dakota at any time during the year must file a bank franchise tax return. 250 minimum tax if DC gross receipts are 1 million or less 1000 minimum tax if DC gross receipts are more than 1 million Tax rates. A financial institution is defined as any banking institution production credit association or savings and loan association organized under the laws of the United States and located or doing business in this state.

The minimum tax is 17500 for corporations using the Authorized Shares method and a minimum tax of 40000 for corporations using the Assumed Par Value Capital Method. United States Supreme Court. Please contact a Franchise Tax Specialist to.

Corporations must pay a minimum tax as follows. Franchise tax bd des. Contrary to what the name implies a franchise tax is.

De Vattel The Law of Nations 486 J. Petitioner Franchise Tax Board of California Board the state agency responsible for assessing personal income tax suspected that Hyatts move was a sham. Effective January 1 2018 a domestic stock or non-stock for profit corporation incorporated in the State of Delaware is required to pay annual franchise tax.

1 1983 103 S. Thus in 1993 the Board launched an audit to determine whether Hyatt underpaid his 1991 and 1992 state income taxes by misrepresenting his residency. 0 7 34363 Reply.

FRANCHISE TAX BD CASTTAXRFD 022117 XXXXX5 1600 022417 Is this something from my tax return. There are 7222 searches per month from people that come from terms like franch Monday April 11 2022 Edit. If the total gross assets andor issued shares equal zero then please contact Franchise Tax at 302 739-3073 option 3.

11 Jun 2020 Latest IBR Articles. I was supposed to get 4700 something. It says FRANCHISE TAX BD DESCASTTAXRFD which google slething tells me is a CA state tax refund.

Argue d Apri l 19 1983 De c i de d June 24 1983. The tax is usually calculated at a flat rate of taxable income. Sources in excess of 12000 per year.

Because our build out costs are substantially lower than other brands in the healthcare segment The Joint offers a quicker ramp-up time to allow. The undersigned certify that as of July 1 2021 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California Government Code Sections 7405 and 11135 and the Web Content Accessibility Guidelines 21 or a subsequent version as of the date of certification published by the Web Accessibility Initiative of the World. Business that is unincorporated which includes partnerships sole proprietorships and joint ventures so long as such a business derives rental income or any other income from DC.

The undersigned certify that as of July 1 2021 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California Government Code Sections 7405 and 11135 and the Web Content Accessibility Guidelines 21 or a subsequent version as of the date of certification published by the Web Accessibility Initiative of the World. Appellant Franchise Tax Board is a California agency charged with enforcement of that States personal income tax law. This also happened to me.

Corporate Franchise Tax Corporations must report income as follows. The unincorporated business franchise tax Form D-30 must be filed by any DC. Franchise Tax BdvLaborers Vacation Trust 463 US.

The Joint is a low-cost investment opportunity with potential for high returns. From sick pay calculation to changing tax and accounting deadlines. You may also use the Franchise Tax Calculator but please note this calculator is for estimating tax only.

There is also a 250 minimum franchise tax. Ante at 7 quoting 4 E. If your tax year matches the calendar year the tax is due on.

I have a traffic ticket which I extended the court date 3 months later. It comes from Panama. Appellee Construction Laborers Vacation Trust for Southern California CLVT was established by an agreement between construction industry employer associations and a labor union to provide a mechanism for administering.

Find information about services that are available for the business tax payer including links to tax forms information about establishing a business in. But Vattel made clear that the source of a sovereigns immunity in a foreign sovereigns courts is the consent of the foreign sovereign which he added reflects a. There are 7222 searches per month from people that come from terms like franchise tax bo or similar.

2841 De c i de d Jun 24 1983 APPE AL FR OM T HE UNIT E D STAT E S C OURT OF APPE AL S FOR T HE NINT H C IR C UIT No. I got it in my bank account but Im not sure if its my tax return. 1 Best answer Accepted Solutions AnthonyC.

Blush Office pink wallpaper. Franchise Laws and Regulations Bangladesh 2022. LABORERS VACATION TRUST1983 No.

Blush pink office chair with arms. Value Added Tax VAT Whole Bangladesh Gazipur Zone. I received a deposit from franchise tax board not matching what my tax return said do I receive my tax return in amounts.

FRANCHISE-TAX-BO-PAYMENTS has been in the DB for a while it is the number 23352. I remember filing my tax return for 2015 and I had paid right on the money to CA I think I was owed a dollar or two back so there is no way this money is from that year. Net income of corporations in the District on a combined reporting basis.

April 19 1983 Decided. Find the best Entertainment Franchises in District of Columbia. I think in 2013 I did end up owing right around the amount that was deposited to the state and I paid it on some.

A franchise tax is a levy paid by certain enterprises that want to do business in some states.

What Is Franchise Tax Bd Casttaxrfd Solution Found

How To Start An Llc In Nevada Llc Business Annual Report Estate Planning

1 Audit Services In Dubai Auditing Services Audit Firms In Dubai Uae Audit Services Business Valuation Accounting Services

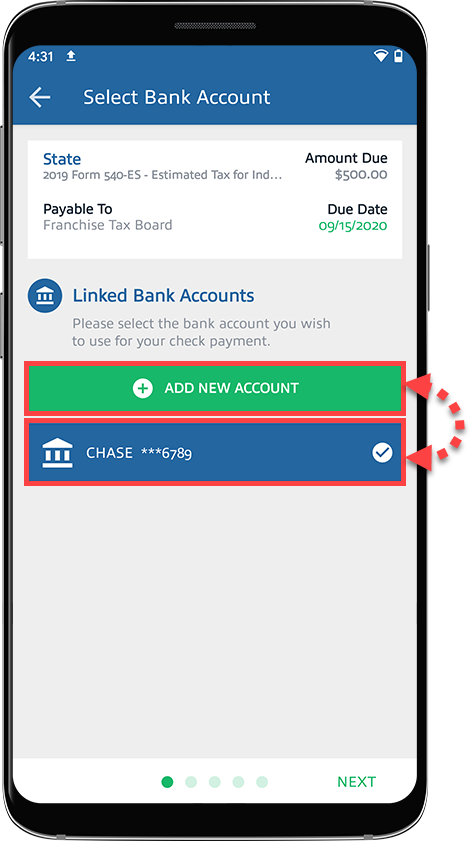

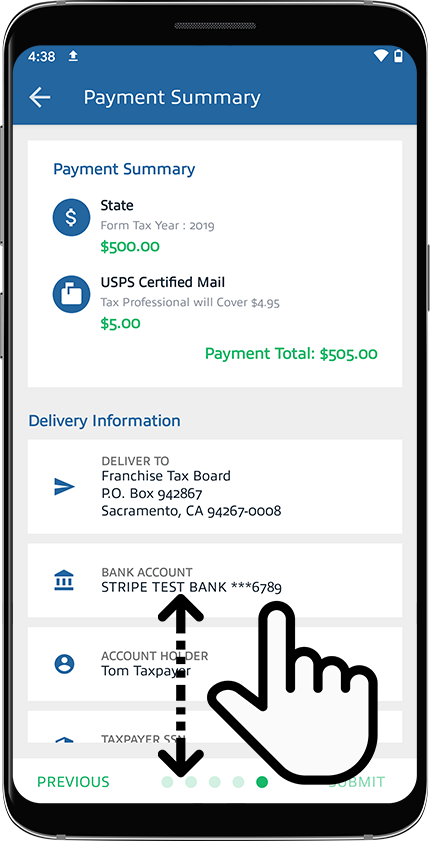

Paying Tax Payment By Check Taxcaddy

How To Pay Ca Franchise Tax Board Taxes Landmark Tax Group

Which Of These 3 Types Of Income Do You Have Money Management Advice Business Motivation Investing Money

California Ftb Rjs Law Tax Attorney San Diego

Franchise Tax Board Payments Arrcpa

California Franchise Tax Board Bank Levy How To Release And Resolve Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

Document Management Proposal Template Request For Proposal Business Proposal Template Proposal Templates

Franchise Tax Board Payments Arrcpa

Franchise Tax Board Payments Arrcpa

Paying Tax Payment By Check Taxcaddy

Monopoly Streets Playstation 3 Monopoly Playstation Games

Filmography Of Cars Chart 24 X35 60cm 90cm Canvas Print Classic Cars Cars Movie Cars

Central Hollywood Coalition Cleared By Franchise Tax Board Of All Fiscal Wrongdoing Tax Exempt Status Reinstated After Months Of Struggle And It Wasn T An Audit After All Michael Kohlhaas Dot Org